The Importance of Cashflow

If you’re not tracking your numbers you really don’t have a business and you certainly won’t have measurable goals to grow your business. What you need is a SIMPLE way of being able to see “snapshots” of how your business is operating each week and month. This will allow you to easily look at the trends in your business and whether or not you are growing. See how I track my numbers each month and download a “Done-for-You” spreadsheet, so that you can track your own fitness business financials!

I’ll be the first person to admit

that I am not a number cruncher or someone that sits at a desk for an hour a

day measuring every detail of my business.

I’ve always been of the

philosophy that if you set your goals on helping more and more people you will

naturally grow your business. And although this principle has served me well, I

have at points lost track of how much money was LEAVING my business…

So, of course, more money was

being generated as I was growing my team and client base, but

my expenses were not being

carefully monitored

, which meant I was paying more for items

that could have easily been consolidated or eliminated.

For example, when started hitting

1,000 client sessions a month our water consumption at the studio was through

the roof. This meant I was having over 20+ 5 gallon water jugs delivered a

month. Madness!

I mean, I’m working with 500 ft

of fitness floor and I have 10+ 5 gallon jugs at a time sitting out on my deck

taking up space and becoming an eye sore…

So what I did was rent a reverse

osmosis water filter from Atlas water company for $50 a month. Now, we’re no

longer paying $200 a month for water jugs and we saved a lot of space.

I made these same types of

consolidations in about a dozens areas of my business, which saved me about

$1,000 a month if wasted overhead.

Save Money in Key Areas Here are some of those areas:

·Water jugs -> Reverse Osmosis

Filter·Printer ink -> Buy in bulk

from cheap online website·Promotional items -> developed

a relationship with company and got deeper discount·Cleaning company -> Better

company with better rates·Supplements -> bought in bulk

for better price·Marketing items -> purchased

quarterly for better bulk price

Those are a few of the areas that

I was able to save in, but one of the

BIGGEST ways I saved money

was

in negotiating a better rate on my credit card processing fees. I was paying

about 3.9% a month and since I’ve been with the same company for about 6 years

and I’m doing a considerable amount of billables per month, I asked them to match PayPal’s 2.9%

.

I let them know I have enjoyed

using their company, but there are multiple companies willing to reduce my rate

to 2.9% and I’d like to stay with them if they can match it.

They did ; ) This saved me 1%

on all my monthly credit card charges

through

Visa and Mastercard. That may not seems like a lot, but check out these

numbers…

If you’re doing $10,000/month a

1% savings = $1,200/year

$20,000/mo = $2,400/year

$30,000/mo = $3,600/year

$40,000/mo = $4,800/year

$50,000/mo = $6,000/year

You get the point…

It’s a significant savings that

is up for the taking if you’re willing to ask for it and do your homework on

which other companies or banks may give you a better rate. 2.9% is pretty

standard and it’s a rate you should strive to get after you’ve been in business

and charging credit cards for a little while.

So now that I’ve reduced my costs

of typical monthly fixed overhead I’m saving about $1,500-$2,000 a month.

That’s anywhere from $18,000 – $24,000 a year! And that’s just pure PROFIT in my pocket!

Now it’s your turn…

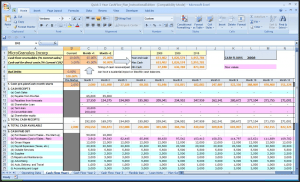

Cashflow Spreadsheet

Okay, not onto the monthly cash

flow spreadsheet.

One of my coaching clients and

fellow Smart Studio Systems Member, Robert Selders, created a excellent monthly

cashflow spreadsheet that frankly is much prettier than mine. So, I asked if it

would be alright for me to allow all Smart Studio Systems Members the privilege

of using it and he, being the nice guy that he is, obliged.

So let us all thank Robert for

not having to use my black and white excel spreadsheet!

Now back to business… This

cashflow spreadsheet is to serve as a template.

What I mean by that is that I’ve

taken out all of Robert’s numbers and left the columns blank for you to fill in

your own stats. However, the left hand column also contain all of the expenses,

as well as profit centers.

I have tweaked his spreadsheet in

order to add in more examples of different profit centers you may have, such as

supplement sales, small group training, 1-on-1, etc. And like any good

cash flow statement you will want to have all your expenses written as

negatives (ex. -1,250) and you revenue as positives (1,250).

This will allow you to create an

easy sum at the bottom of your spreadsheet showing you how much money is coming

in after all your expenses have been taken out. Remember, it’s imperative that

you

seek out all

the opportunities to reduce your overhead and monthly expenses

,

while obviously working to boost your revenue.

I state this because people often

forget that if you save $1,000 a month that is the same as making an additional

$1,000 a month. Only, it’s usually easier to save the money, since

consolidating or cutting allows you to not have to do any extra work!

Fixed Costs

At first when you’re filling out

the cashflow spreadsheet it may take a little extra effort since you may not

have been gathering all your monthly expenses, but after you have the first

month down you’d be surprised at how easy (and fun!) it is to plug in your

numbers each month. The reason for this is that many of your expenses do not

change month to month – which is why we call

them “fixed overhead costs.”

These fixed costs are typically:

·Rent·Electric bill·Heat/AC·Cable·Internet·Phone·Wireless phones·Car·Ongoing advertising (not big

promotional items which are not fixed)·Loans·Assistant (although this can be

reduced as it is not fixed)·Water for studio·Website hosting·Newsletter/email hosting account

You get the picture…

So basically what you want to do

is pull out your credit card and bank statement and find all the debits that

come out of your account and write them in your “expense” column. You can then

have a miscellaneous column or just keep adding lines of expenses as they come

up each month.

What I do is actually have all of

my fixed bills debited from my bank account and then my monthly expenses that

are in addition to my fixed overhead come out on my American Express business

card. This allows

me to see how many “soft costs,” I have each month

, and those

are typically the ones that can fluctuate a few thousand dollars. The itemized

list AMEX gives me each month and at the end of the year is a great way for me

to make sure I am only purchasing items I need for my studio/business in order

to keep costs under control.

So now that you have the nuts and

bolts of what I am talking about, please download this S3 Cashflow Spreadsheet

and put in some work!

>>> Download the

Cashflow Spreadsheet here

Remember, it’s only difficult to get going the first time and

then it’s smooth sailing from then on out. Plus, as I stated before it is impossible to know if you

are hitting your goals if you’re not actually dissecting your numbers

.

Advanced Tracking

Now, for those of you that have

already created a cashflow spreadsheet, just look over this new document and

make sure you haven’t left anything out. Then if you’re ready for the next step

you can begin tracking your bootcamp, small group, or semi-private attendance,

and your 1-on-1 sessions. Then you can track all your leads calling in, your

comps set up, and your conversion of those leads to clients. The sky is the

limit on what you can track

, but I don’t want you to get

overwhelemed in the beginning, so I recommend just starting with the financials

spreadsheet and then when you’re ready move on to additional numbers.

Lastly, some people can get overly fixated on studying their

numbers. However, my advice to you is to look at your

financials each Friday and then the 1st of every month

in order to take snapshots of where

your business is heading and if you’re on target to reach your goals. I believe

daily updating and obsession over your numbers takes you away from the bigger

picture of focusing on your team and your clients. After all, this is personal

training and retention and referrals come

from over delivering on your services

.

Yours in Fitness Business Success,

Ben Dulhunty